It’s the start of a New Year 2016 and that means its time to look back and see what it all means and with that knowledge can we predict what 2016 holds?

Maui Real Estate December 2015 Statistics. You will notice comparisons to Dec. 2014 as well.

Here is the 2016 Year End Report. You will also find 2015 compared to 2014.

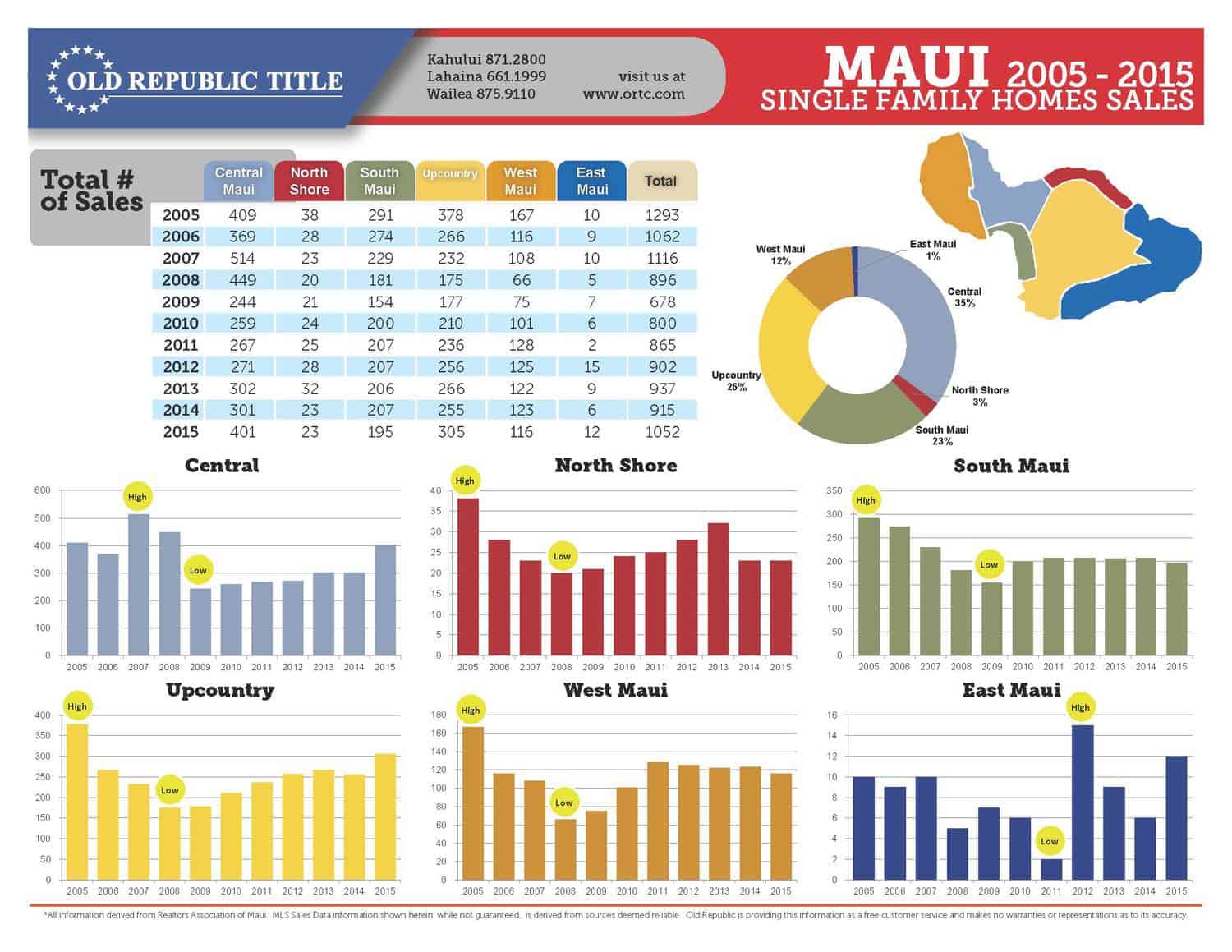

Maui Real Estate 2015 -Single Family Homes

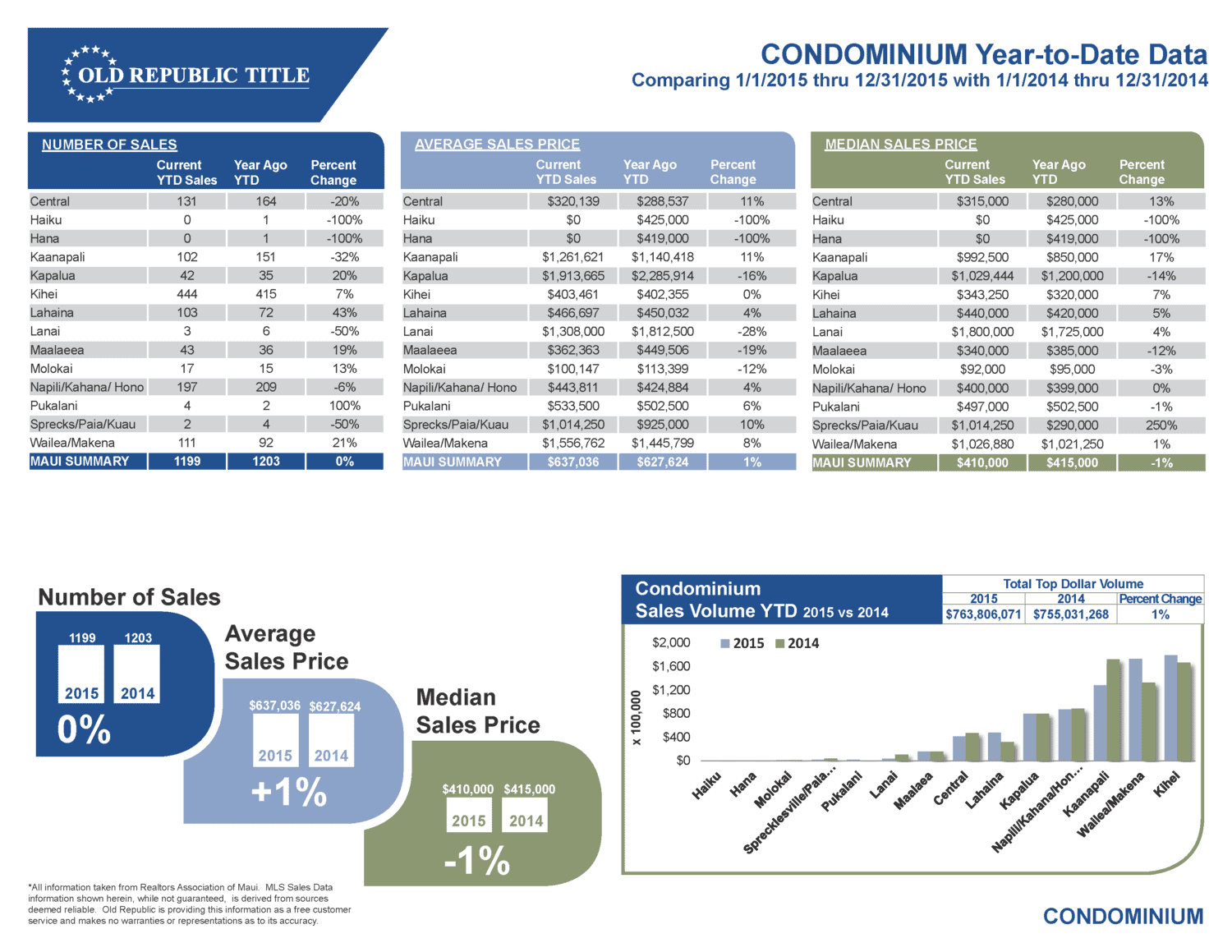

Maui Real Estate 2015-Condominiums

Maui Real Estate 2015- Land

In 2015 approximate 61.55% of all transactions had Financing. 36.11% of all transactions were in CASH. 2.02% were 1031 Exchanges and 0.32% were “other”.

2015: Residential = 1,089 (with 11.8% being REO or Short Sale), Condo = 1,199 (6.6% REO or SS), Land = 154 (3.9% REO or SS).

REO= Bank Reowned SS=Short Sales

For Absorption Rate enthusiasts who calculate only pure “Active,” (not any pending/contingent) divided by December Sales: Residential 568 “Active”/92 Sold = 6.2 months. Condo 821 / 101 Sold = 8.1 mos. Land 343 / 9 Sold = 21.4 months of inventory.

According to Terry Tolman (RAM Chief Staff Exec.):

“IN A NUT SHELL…… Monthly Residential and Condo Unit Sales numbers recovered from November’s dip. Canadian investors have been big participants in Maui’s real estate market, however the current Canadian Dollar exchange rate (.71 US $) may motivate Canadian investors to sell, rather than buy.

Increased showings and sales, multiple offers on “well priced” listings, hesitant buyers become onlookers…… Window of opportunity is quickly closing for first-time homebuyers (see below).

“CASH is King!” when making an offer. For several months approximately 37% of all sales were CASH.

Well priced properties are attracting multiple offers making for a quick sale. REO (Foreclosures) and Short Sales are dwindling, with any “hidden inventory” (or overhang) backlog slowly trickling onto the market. Mortgage

Interest Rates are inching up slightly which may help motivate would-be Buyers to go ahead and buy IF they can qualify. Savvy Investors are buying with Cash, giving them a strong negotiating position, no financing/appraisal hassles and a quick closing. While general U.S. economic news looks cautiously hopeful, current World and US events will have ripple effects on cost of living, consumer confidence, Financial and Real Estate Markets.

Rising Sales prices cause some “Owners” to become “Sellers,” putting their homes on the market.

FOR SELLERS: Sharpen your pencil, talk to your CPA and your Realtor® to explore the hidden benefits or consequences. Make no assumptions that will sting later.

To be successful, Sellers need to beat competing properties with better property condition, realistic pricing, good marketing, and flexible, creative terms. Days on Market figures show that properties priced right will sell in a reasonable timeframe, often with multiple offers. “Priced Right” is still the determining factor.

BEST Deals are selling, while significantly over-priced listings remain un-sold.

Pro-Active Sellers are getting their properties appraised, inspected and surveyed in advance to encourage realistic offers from knowledgeable Buyers. This can prevent unanticipated escrow fallout or Buyers whittling your price down during the transaction when previously unknown facts come to light.

FOR BUYERS: Low interest rates prevail; however have started to nudge up and are predicted to rise later in 2015. Buyers should get Pre-Approved so they can shop in confidence (fewer last minute disappointments due to non-funding loans). “Short-sales” and foreclosures are still in the marketplace, yet they can be less of a bargain than they seem, requiring more hurdles to leap and more time (often 4-6-12 months) to close, if at all.

Be prepared, but BE REALISTIC. Lenders are more stringent on requirements now for loan approval, compared to 2004-2008.

First-Time Home Buyers – Many programs are available….. Attend a First-Time Home Buyers workshop, get familiar with the process, get qualified/approved, do your homework to get your own home. Many current owners never thought they would be able to own until they attended a workshop, discovered they could own a home, and are glad they did.

The low point in the market has passed, so check it out carefully NOW, don’t delay. The opportunity is fading quickly. If you can’t buy now, start saving your down payment for the next market cycle.”

december_2015_and_year_to_date_stats

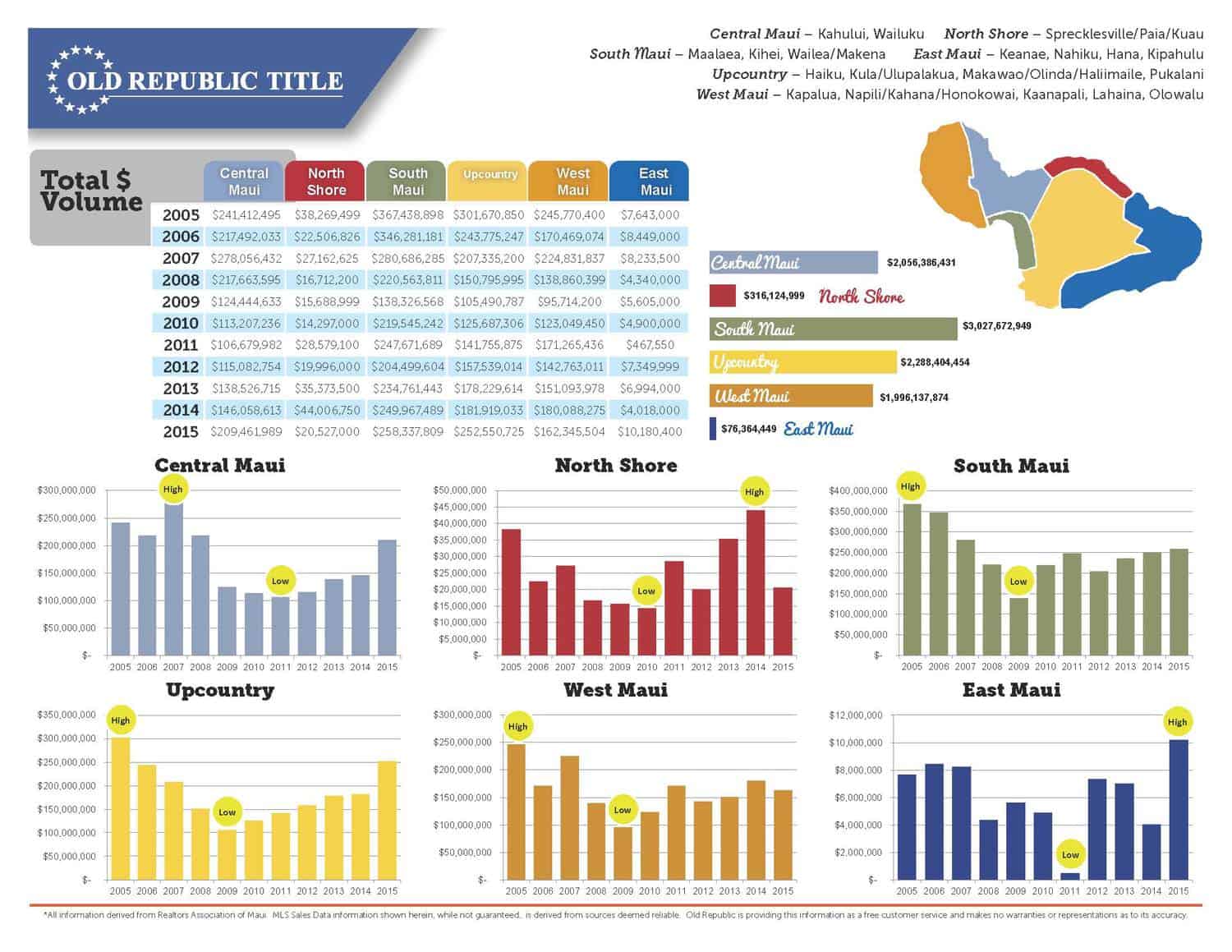

Lets look back 10 Years to get an idea of trends in our Market.

Maui Real Estate 10 Year Review: Single Family Homes 2005-2015

Maui Real Estate 10 Year Review: Condominiums 2005-2015

![maui-real-estate-ten-year-review-condos-2005-2015_page_4[1]](https://www.livingonmaui.com/wp-content/uploads/2021/09/maui-real-estate-ten-year-review-condos-2005-2015_page_41.jpg)

I hope you found this blog helpful and useful in making decisions in regards to Maui Real Estate. We are here to educate and advocate for you. The decision to buy is a personal one but by definition it is also an investment. So being informed is critical in your process.

Maui’s real estate market is very localized. Different market conditions may differ widely from one neighborhood or condo complex to the next. So please don’t hesitate to call me or email me to receive more detailed information in your area of interests.

Email me if you want a PDF copy of all graphs in this report.

A hui hou…. (until we meet again). Mahalo (Thank you) and Happy New Year 2016.

Best wishes and warmest Alohas,

Jeannie Kong REALTOR®(S) RS-68054

Direct line: 808-276-1832

Email: Jeannie@JeannieKong.com

Maui Real Estate Advisors, LLC

161 Wailea Ike Place A-102

Wailea, Maui, HI 96753

Disclaimer: Zooming in on the figures of a specific geographic area or property type may lead to different conclusions that looking at the overall view. Maui’s market place is much smaller than Oahu’s, and a few high or low sales have a greater effect on the statistical numbers without necessarily indicating a big market swing one way or another. Information deemed reliable but not guaranteed.

All photos have been taken by Jeannie Kong. All rights reserved. Statistics provided by RAM. Graphs courtesy of Old Republic Title on Maui. Thank you!